By Dean C. Hurley, Managing Director, Structured Products and Whole Loan Valuation Group

Dick Kazarian, Managing Director, Borrower Analytics Group

MIAC Coronavirus Macrofactor Scenarios

MIAC has revised our March-end macrofactor scenarios that show how we view the economy over the next three years because of the Coronavirus pandemic. We have sketched out possible ranges of increased unemployment, slightly different Residential and Commercial property value movements, and reduced nominal GDP. Our Baseline scenario reflects what we view as the most probable outcome given current information. While no one can forecast future events with complete accuracy, MIAC believes that historical events such as the 2008 housing crisis and several natural disasters help develop COVID-19 forecasts. Our updated forecasts are described in the following graphs and tables.

How Did We Develop these Scenarios?

MIAC has continued to review data available to the industry through numerous sources. These include the Bureau of Labor Statistics, pricing data from JPM, BofA, Goldman and Trepp, commentaries from Rating Agencies, and forecasts of leading economists, the MBA, and other industry associations. We have also been reading extensively about the Coronavirus, the measures epidemiologists have been recommending, and the experience of past pandemics and disaster relief efforts, including loan modifications and the effectiveness of government efforts. Our review has informed our construction of these updated macrofactor scenarios.

Scenario Descriptions

- Base Case is only some folks most at risk lose jobs, with federal mitigation of the UER. Housing does not succumb much because folks that can hold on and delay plans rather than panic sell (3% quarter-over-quarter declines in HPI to June end, followed by a 1.25% quarterly growth resumption).

- MIAC feels that a 16.5% UER level at the end of May with a slight decline to 16% at the end of June will be the likely peak

- MIAC considers this outcome to be 80-85% likely

- Adverse case assumes levels consistent with the mainline forecasters at 18.25% UE peak and a slow decline in the UER. The housing price decline is 8.5% quarter-over-quarter to June end, followed by a period of very slow improvement of under 1% quarterly.

- This forecast is broadly in line with the other commentators

- MIAC considers this outcome to be only about 10-15% likely

- Severely Adverse Case – MIAC’s worst-case – is all these “at-risk industry” folks (plus some people working in jobs supporting these sectors) lose jobs. Housing price declines are 10% quarter-over-quarter to June end, followed by a very slow rise.

- The peak UER in MIAC’s worst case is 20.5% at the end of June 2020

- We consider this outcome to be only 5% likely

Markets Overview – The Environment

We have been seeing buyers returning to markets since we last wrote March 30 about the effects of the Coronavirus Disease 2019 (“Covid-19”) shutdown of large chunks of our economy. Many may be surprised to hear that there is buyer demand in the whole loan space. More below. MIAC’s position remains that only by properly modeling the expected future cash flows on these Level 3 assets, and then dealing with spreads independent of “Panic Bids”, can a correct ASC 820 valuation be reached. MIAC presents revised Coronavirus 2020 Macrofactors scenarios as of April month-end in this paper.

Broad Markets Observations

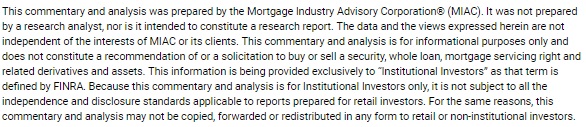

- The latest thinking is that we will see a “Swoosh” shape recovery. We agree.

- This is closer to a “V” shaped than a “U” shaped recovery (as 2008 was), and as before our forecasts reflect our view that 20 million jobs will not re-appear in a short time

- See Figure 1

- Business bankruptcies have not yet spiked (we only have March-end numbers), and future increases could mean millions of jobs will not return.

- The possibility of a second wave of infections and closures also remains real and is not explicitly included in this forecast

- Viable treatments still could happen soon (Steroids, Hydroxychloroquine, and azithromycin are still being cited, along with other drugs like Gilead’s Remdesivir anti-viral) or be more than a year away. Vaccine development typically takes years.

- We have had to revisit our unemployment forecast. It now seems possible that unemployment could peak at 18-20%, as many other economic sectors have been hit in varying degrees.

- See Figure 2

Figure 1: Source: Wall Street Journal, May 12, 2020, and The Brookings Institution

Figure 2: Source: American Bankruptcy Institute

- Whole loan secondary markets are no longer operating at panic bid only. We see renewed demand in the prime Jumbo and agency-eligible space. We also see more demand for other Non-QM – with bid levels in the low 90s. Commercial loan bidders remain very cautious, but the example of those who have bought munis, lodging, and office judiciously and now show gains is making others start to stir. We have seen recent evidence through our trading desk, news reports, analyst calls and SEC reports that these kinds of trades were happening in March and April.

- Equities markets have continued their recovery (up 31% since the 2020 low on March 23), with support from continued fiscal and monetary actions by Congress and the Fed, plus news reports that lifting of lockdowns will start soon in the many US and international locales. No one wants to miss a sustained rally, and many buyers are back. Plus, there is no other major market to get yield at moderate risk. The ten-year Treasury was at 0.679% Friday, May 8, while the dividend yield of the S&P 500 is about 2%, according to a Friday Wall Street Journal article.

Figure 3: Source: NASDAQ OMX Group

Residential Housing Markets

- Mortgage Lenders: It is well-known in the mortgage industry that non-bank lenders have assumed primacy from the banks. The Fed did a study of the liquidity risks in 2018.

- This graph appeared in the Wall Street Journal on Saturday, May 9th

Figure 4: Source: Wall Street Journal

This highlights the growing importance to mortgage markets of institutions that are not funded by deposits or backstopped by the US government. Many servicers lack the capital to fund servicer advances for several months on a sizable chunk of their loans. Mortgage servicers, both bank, and non-bank owe about $4.5 billion a month in servicing advances on government-backed mortgages, or more than 25 times the levels at February month-end. About 7.5% of borrowers have obtained forbearances (versus 0.25% at the beginning of March), according to the MBA in a May 5th article. Fortunately, Ginnie Mae is helping with cash to the non-bank mortgage lenders repurposing programs normally reserved for natural disasters to do so.

- The Coronavirus crisis is making mortgage availability for many types of credit vulnerable. After 2019’s refi boom, mortgage lenders have pulled back on making many kinds of loans, including jumbo loans, loans based on assets, cash-out refis, and low-FICO loans. It should not be surprising that loans that can be sold into the government mortgage agencies would take preference over other kinds of mortgage lending in a time of crisis.

- Housing Markets: With mortgage lenders offering forbearance and/or payment deferral, and many other lenders doing the same (including consumer unsecured lenders), plus enhanced Federal stimulus benefits, we see default risks being substantially mitigated for at least 90 days and probably longer.

- With interest rates at record lows, there is a strong push for refinancing hitting the industry. Government programs are providing significant liquidity to the industry.

- However, sales of homes will be scaled back as potential buyers stay home during the lockdown phase which could last weeks or months

- Debt service levels are at relative lows, and this supports MIAC’s view that while housing will lose some value, a home price catastrophe is not in the offing

- Many commentators believe housing prices will rise during the crisis on a national level, but at annual rates of 0.5%, down from the March 2019-March 2020 annual rate of 4.5% according to CoreLogic. Of course, places like Houston (dominated by the energy sector) and Las Vegas (dominated by the entertainment industry) are seeing large price drops now. Houston is projected to be down 2.6% year-over-year. Miami and Las Vegas are expected to see lower price decreases, while San Francisco and San Diego are expected to see strong gains.

- MIAC believes housing prices may decline somewhat in the second quarter of 2020 but will recover as restrictions are lifted and people start returning to work and home buying can resume. Our scenarios show this conservatively as compared to forecasts showing only a slowdown in rising prices.

Figure 5: Source: St. Louis Fed

- CMBS 2.0 Spreads remain elevated but have started falling back towards earlier levels, most notably for the highest credit grades.

Figure 6: Source: Trepp

- ABS Spreads have also started falling back towards earlier levels, but have not recovered as quickly as the CMBS spreads at the higher credit grades

Figure 7: Source: JPM

Commercial Property Markets

- Retail was weak before the crisis and is getting hit hard due to closings. But many retail businesses have been able to remain open, such as drug stores, supermarkets, take-out restaurants, and auto repair facilities.

- Lodging and Leisure were doing nicely and has been hit hard by the sudden stop to their business. Travel is down 90%, and 90% of their revenues have vanished, according to the airlines.

- Office leasing is slowing, but in general, the sector is not being hit as hard immediately. Work from home will have a longer and more gradual impact on office markets. Because leases are longer-term, most tenants cannot immediately release space and are not as likely to default. However, as leases renew, many office tenants may opt for smaller spaces to reduce their exposure in case another pandemic occurs.

- Warehouse/logistics centers and Data Centers have a strong role in linking the world together and will continue to fare well in the new environment. E-commerce constituted 12% of retail sales in 2019, up from 1% in 2000. The current pandemic is accelerating that trend.

- Multifamily housing is more necessary than ever. Although exposed to unemployment risk, with enhanced unemployment insurance and government cash assistance extended through middle-income levels, multifamily is poised to do better than before.

- Self-Storage will remain largely unaffected or may see additional business, as some people take steps to pare back

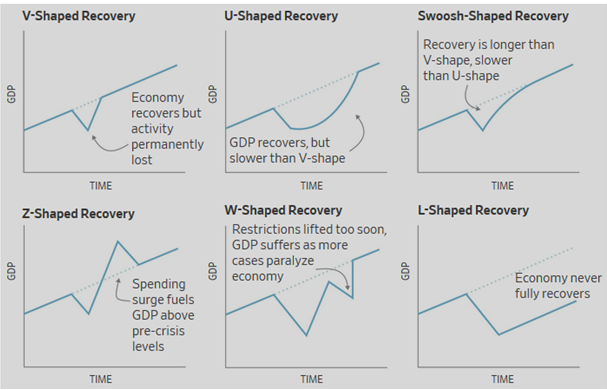

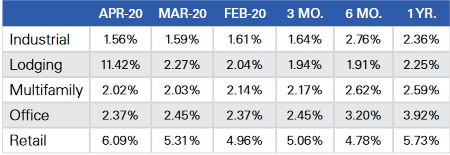

- Currently, 4.39% of CMBS loans are in special servicing as of April end, versus 2.83% in March per Trepp. This is nowhere near the 13% in special servicing in late 2011 and the sustained 9.5%+ peak delinquency rates of 2011 and 2012, but the numbers are still developing in this crisis. Some commentators are speculating that we could get to these levels again.

Overall CMBS Special Servicer Rates by Property Type

Figure 8: Source: Trepp

Figure 9: Source: Trepp

MIAC Coronavirus Macrofactor Tables

Baseline Coronavirus Scenario

Adverse Coronavirus Scenario

Severely Adverse Coronavirus Scenario

Valuation Using MIAC’s Vision and CORE Models

MIAC can see current market bid levels on whole loan assets – what ASC 820 classifies as Level 3. As the shutdown started, bids were what we would call “panic bids”. Today, buyers are returning, and more of the bids are reflective of true market levels under ASC 820 Fair Value standards. The accounting profession has made clear that panic prices are not market prices.

- The lowball “panic” bid levels are not sustainable, as more buyers determine that real levels of losses are likely to be far less than the panic bids assume. This is what happened with RMBS and ABS bonds and whole loans during 2009-2010, and it is happening again now.

- All appraisals include a “market time” to realize the value started. Panic bids envision closing in very short timeframes – like a week.

Market Spreads and Pandemics – True Market Spread Changes Reflect Uncertainty

Credit losses are always baked into panic-driven market spreads. To reach true market spreads, one must first determine the real level of losses likely to be realized because of the changes in the macro-environment.

- Then one can modestly adjust for uncertainty premiums to the pre-crisis spreads

- Our Vision 2.1 models (covering all loan types) and MIAC CORE 6.1 for Residential are all macrofactor sensitive, generating defaults, losses, and prepayments based on the macrofactors in the forecast scenarios

.

Research Insights (UPDATE): Modeling the Impact of Covid-19 on Whole Loans – Credit, Cash Flows and Valuation

Author

Dean C. Hurley, Structured Products and Whole Loan Valuation Group

Dean.Hurley@miacanalytics.com

Author

Dick Kazarian, Managing Director, Borrower Analytics Group

Dick.Kazarian@miacanalytics.com

View as PDF

Read the latest MSR Market Update