MarketShield®

Secondary Market Risk Management Software

MarketShield® is the center of MIAC’s secondary mortgage marketing risk management software solution, providing loan-level best execution, price discovery for interest rate lock commitments, closed pipeline loans, and their related hedges to reduce pipeline-related risks.

Effectively Manage your Mortgage Pipeline in Today's Volatile Market

Flexible Position Reporting

MarketShield allows you to customize your position reporting in the format that best suits your business. View reports in the aggregate, or in user-defined subgroups by business unit, product grouping, or trader. View any position in terms of P&L shocks, duration-weighted notional exposure shocks, or traditional matched coverage “slotting and bucketing” approaches.

Robust Shock Analysis

MarketShield provides a valuation of each loan and hedge in the position, which allows movements in the overall P&L to be carefully monitored. Position reports can be generated multiple times a day to capture the impact of pipeline changes or market movements while retaining all historical position data.

Loan Level Market-to-Market

Market-to-markets are performed on every loan in the pipeline, considering each loan’s exact best execution and each lock’s closing probability. Users can choose to include or exclude the value of MSR, and interest carry.

Best Execution, Gain/Loss Reporting and Accounting

MarketShield provides flexible, comprehensive, and accurate best execution modeling.

Models and Analytics

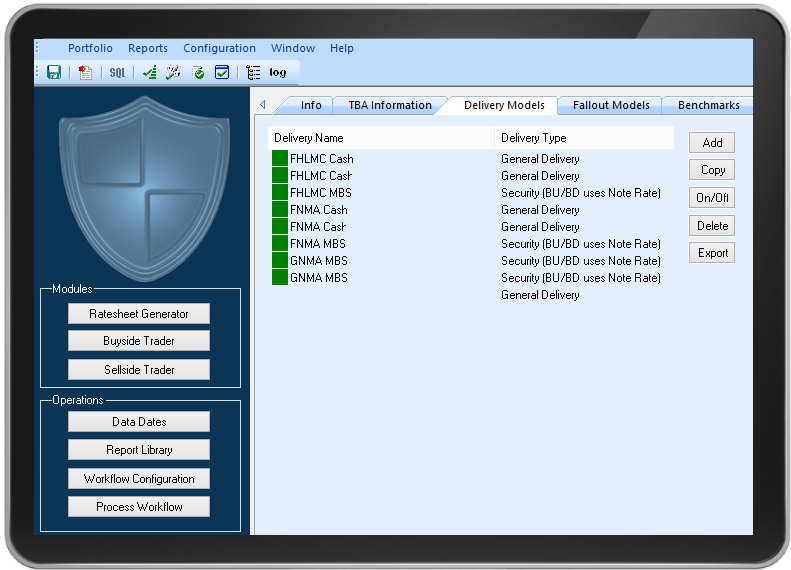

Fallout Models

Accurately predicting your fallout behavior is critical to achieving optimal hedge performance. MarketShield provides comprehensive fallout analysis and client-specific reports based on those elements important to your business. MarketShield’s fallout projection overlays historical market behavior to your pipeline’s sensitivity to market movement. This analysis provides you with a more accurate picture of your pipeline’s interest rate sensitivity.

Interest-Rate Model

Effective hedging begins with the accurate measurement of the price’s sensitivities of the underlying assets and hedges. MarketShield’s option-adjusted spread (OAS) analytics enables capital market risk professionals to accurately measure the anticipated price sensitivities of their pipeline. Once value at risk is accurately measured, risk managers have the information they need to place a hedge.

MSR and SRP Modeling

Mortgage Servicing Rights (MSR) and Servicing Released Premium (SRP) valuations can be user-defined, investor defined or calculated using MIAC’s industry-leading WinOAS™ MSR cash flow valuation model. MSR, SRP, and excess servicing values can be held at the base shock or recalculated during the rate shock process, allowing MSR exposure to be incorporated into the overall hedge strategy for optimum results.

Multi-layer Application

MIAC can provide you with Secondary Market tools through its pipeline hedging solutions.