MSR Hedge Advisory

In addition to our MSR valuation capabilities, MIAC offers MSR hedge advisory services. Our advanced term structure model, comprehensive risk metrics, rigorous and robust protocols, and large hedge instrument library enables our team to synchronize with the business objectives of our clients.

Hedging Process Framework

Policy Formation

-

Objective of Hedging, Coverage Levels, Hedging Goals

-

Approved Instruments, Constraints, Authority, and Limits

-

Risk Tolerance

Qualitative/Quantitative Risk Assessments

-

Monte Carlo Simulation

-

Assumption Sensitivity

-

Identify Risk Driver Interactions

-

Computing Risk Exposure, Hedge Risk Profiles

Strategy Implementation

-

Monitor, Execute, and Rebalance Hedging Strategies

-

Performance and Risk Profile Reporting

-

Continual Reassessment of Hedge and Model Performance

Understand and Attribute Results

-

Careful Measurement of Key Risk Attributes

-

Analyze and Assess Retrospective Results

-

Assess Risk Tradeoff Decisions and Identify Risks to Address

Optimization

-

Hedging Mix that Optimizes Risk/Return Given Policy Constraints

-

Analysis of Hedge Alternatives and Recommendation for Hedging Strategies

Performance Review

-

Market Analysis/Tools, Techniques, and Assumptions Used

-

Analysis of Existing and Alternative Strategies

-

Monitor and Discuss Results

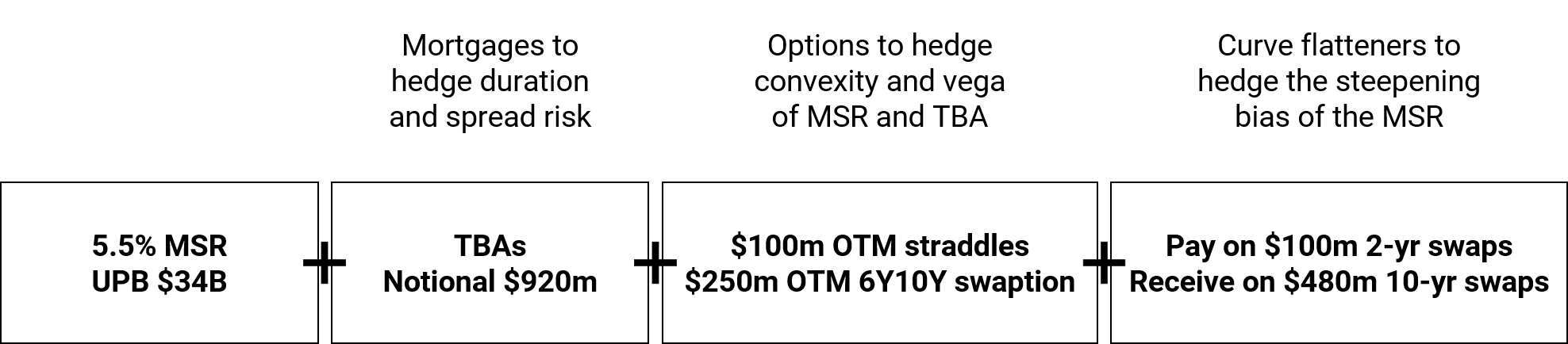

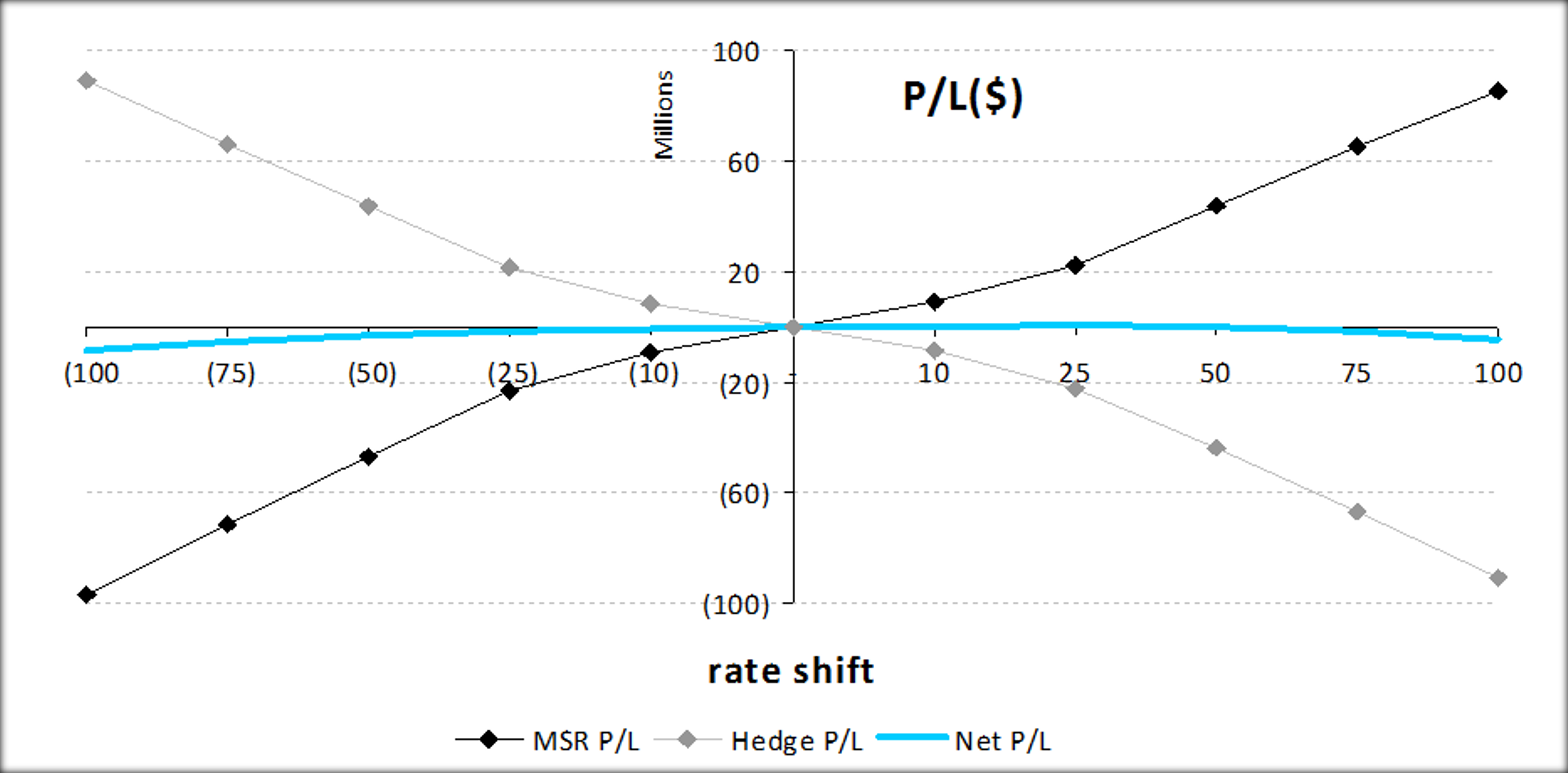

MSR Hedge Construction

Objective of Hedging = Risk Minimization

Optimization

-

Optimize Risk/Return given Policy & Cost Constraints

-

OTC vs. Exchange Traded: Liquidity/Rebalancing Flexibility

-

Hedge Costs & Margin Requirements

-

-

Duration & Basis Hedge: with Mortgage TBA’s vs. Interest Rate Swaps vs. Options

-

Convexity and Vol. Risk: Managed with Dynamic Hedging using OTM Options

-

Use Key Rate Partial Duration Reports in VAST, to determine the swap tenors needed to offset the remaining yield curve risk

Market Risk and Hedging Solution for MSRs

Features

-

Variable Assumption Set Tool (VAST) models the market risk with user control over model parameters including term structure shape, basis spreads, forward time periods, volatility surfaces, prepayment models, and economic conditions

-

MSR and Whole Loan Hedging Analytics: Derivative Pricing, Horizon Analysis, and Prospective/Retrospective Attribution Analysis

-

KRD’s and Key Volatility Analysis (KVA) Tool